Government of Alberta Budget 2021 Analysis

Government of Alberta Priorities: Budget 2021

The provincial government’s Fiscal Plan for 2021 includes recurring themes of economic recovery, economic growth, and job creation. Although the nonprofit sector has a large role to play in recovery, including economic recovery, it remains unmentioned in the Budget 2021 Fiscal Plan. The nonprofit sector employs more than 286,000 full-time and part-time employees and contributes over $5.5 billion in GDP to Alberta’s economy.[1] Support for the nonprofit sector would create new jobs while re-establishing jobs lost on account of the pandemic, guarantee job security for those already working in the sector, continue providing essential services for Albertans, and make Alberta more vibrant and appealing for young people and other future generations. Our budget recommendation for a $350 million Social Infrastructure Fund was not included in the recent 2021 budget, but our work continues to see it realized in 2022.

To illustrate the current Alberta provincial government priorities, Figure 1 compares the total percent increase or decrease of Alberta’s 2021 Budget compared to the 2020 Budget in key Ministries. It shows that many Ministries that work with the nonprofit sector such as the Ministry of Culture, Multiculturalism and Status of Women and the Ministry of Community and Social Services, have seen a decrease, a stable budget, or a small increase over the last year. Comparatively, the Ministry of Jobs, Economy, and Innovation and the Ministry of Labour and Immigration have seen significant increases in the 2021 budget. The increases in these key Ministries reflect the priorities set by the government with policies and programs aimed at increasing investment and trade into the provinces’ economy, mainly focused on the energy sector, with some investment in the tourism industry and programs that support innovation in the tech ecosystem. Additionally, other areas of investment are aimed at skilled immigrants and decreasing costs for businesses. Figure 2 shows that these trends are projected to continue with an overall decrease in Ministries with ties to the nonprofit sector and continued investments in the Ministry of Jobs, Economy and Innovation.

Nonprofit organizations across the province will continue to feel a financial impact from Budget 2021 spending cuts. Many of the programs that nonprofit organizations rely upon will face reduced funding. Some funding increases are the result of readjusting, shifting, and reducing funds for other programs (see figure 8). The government has a plan to “deliver services more efficiently” while supporting one of their three fiscal anchors to bring “spending in Alberta in line with other comparator provinces.”[2]

This report, created in partnership with the Edmonton Chamber of Voluntary Organizations (ECVO), is an analysis of Budget 2021 as it relates to the nonprofit sector in Alberta, which includes highlights of key Ministries.[i] Since the first budget of the current government, we now have access to 2019 Actuals, a 2020 Budget, the current 2021 Budget, and budget targets for 2022 and 2023. Much of our analysis shows the change in dollar amounts over time in key Ministries and programs.

Figure 1: Comparing percentage change of Budget 2021 to Budget 2020 of key Ministries.

Figure 2: Comparing Year-to-Year Budget 2019, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Impacts on the Nonprofit Sector: Key Ministries

Ministry of Culture, Multiculturalism and Status of Women

The Ministry of Culture, Multiculturalism and Status of Women has programs that support nonprofit organizations across Alberta. This ministry has been experiencing budget cuts since 2019. The ministry is expected to receive $230 million for 2021-22 – a total $20.2 million cut from Budget 2020-21 and a $23.3 million cut from the 2019 Actual. According to government targets for 2022 and 2023, the ministry will continue to see reductions – an allocation of $191 million in Budget 2022 and $181 million in Budget 2023 (see figure 3).

Figure 3: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Ministry of Community and Social Services

For budget year 2021, the Ministry of Community and Social Services expects to receive $3.89 billion. The current amount is much less than the Actual seen in 2019, which was $4.03 billion. Within the next two years, spending on the ministry is expected to increase by 2% compared to 2021 (see figure 4). Despite this, these figures do not bring the ministry's budget up to Actual 2019 levels.

Figure 4: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Impacts on the Nonprofit Sector: Key Programs and Departments

MINISTRY OF CHILDREN’S SERVICES

Child Care

Budget 2021 for Child Care within the Ministry of Children’s Services, was reduced by $15.3 million since Actual 2019 and an additional $584 thousand this year compared to Budget 2020 (see figure 5). As part of the $1.2 billion program to support child care across Canada, funds were distributed to support the Early Learning and Child Care (ELCC), or better known as the “$25-a-day-child care” pilot program in 2017 and the child care subsidy.[3] However, the province did not renew the ELCC program and instead introduced a redesign of the subsidy program. While some families will benefit from the new subsidy program, other families may not – specifically those families that were benefiting from the $25-a-day program and received the maximum subsidy amount.[4] If we assume child care costs “$1,000 per month, that relatively small number of lower-income families could see their payments change from $1/day or less to about $13/day once the pilot program ends” in March 2021.[5] Additionally, “wealthier families that were also part of the $25-a-day pilot would also be worse off, although with milder affordability concerns.”[6]

The Government of Alberta has implemented the Working Parents Benefit, a $108 million program that helps families in low- and middle-income households who employed different forms of child care between April 2020 and December 2020.[7] The government estimates that this one-time payment of $561 per child will support 192,000 children. A program like this benefits struggling families who need child care support, however, it can be considered only a short-term solution, and it does not benefit all families. Families who did not have child care between April 2020 and December 2020 due to a job loss are not eligible for the program. In addition, families still have to pay for quality child care over the long term, which is not a part of the program.

Figure 5: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Since 2019, the Government of Alberta has cut the following early learning and child care programs that support families, child care centres, and workers in Alberta:

Stay-at-Home Parent Subsidy: A subsidy for families where at least one parent stays home to care for children 6 years of age and younger, and does not work or go to school for more than 20 hours per week.

Kin Child Care Subsidy: This subsidy assisted eligible families with children 0-12 years of age and not yet in Grade 7, who pay a relative to care for their children.

Benefit Contribution Grant: A program that offset the costs of mandatory employer payroll contributions such as the Canada Pension Plan, Employment Insurance, vacation pay, and statutory holiday pay. This leaves child care centres to pay the extra costs at the expense of increasing fees for parents.

Staff Attraction Incentive: This incentive was available to eligible programs that hire new and experienced staff who were certified as Child Development Worker or Child Development Supervisor. Those eligible child care staff could have received $2,500 at the end of 12 months of employment, up to a maximum of $5,000 upon working 24 months.

MINISTRY OF COMMUNITY AND SOCIAL SERVICES

Family and Community Support Services

The Family and Community Support Services (FCSS) budget,within the Ministry of Community and Social Services, will remain unchanged for 2021-22 (see figure 6). FCSS-funded programs provide support for individuals, families, and communities through preventative social programs and services, which benefit Albertans experiencing vulnerabilities. In light of the detrimental impacts of the pandemic on communities across Alberta, nonprofits have seen an increase in demand for services and funding that does not address the rising demand presents challenges for the sector and the individuals and communities it serves.[8]

Figure 6: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, and Budget 2021.

Employment and Income Support

The Employment and Income Support division within the Ministry of Community and Social Services will receive $856.6 million for Budget 2021. As a result, this is lower than Budget 2020 and Actual 2019, by approximately $153.3 million in 2019 and by $82.2 million in 2020. The Government of Alberta plans to further decrease funding for this division by 2% in 2022, and 9% in 2023, compared to 2021 levels.

Homeless and Outreach Support Services

Homeless Support and Outreach Support Services Budget will see a modest decrease in 2021 compared to 2020, with a total budget of $193 million. Yet, compared to levels in 2019, this is a $34.3 million decrease. Funding will remain flat in the Budget 2022 and 2023 targets.

MINISTRY OF CULTURE, MULTICULTURALISM AND STATUS OF WOMEN

Community and Voluntary Support Services

The Community and Voluntary Support Services department within the Ministry of Culture, Multiculturalism and Status of Women, provides funding for the Community Initiatives Program (CIP), Other Initiatives (OI), and Major Fairs. In Budget 2021-22, the overall budget for Community and Voluntary Services is $99.2 million, a slight increase of $1.6 million from Budget 2020. By 2022 and 2023, the ministries section will receive budget reductions; $74.8 million for 2022-23 and $63.2 million for 2023-24 (see figure 7).

Figure 7: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

CIP, which funds community groups, is expected to receive $37.1 million for 2021-22 (see figure 8). In comparison to Budget 2020, this amount represents an increase in funding of 88% or $17.4 million. The increase is primarily to support the new $17 million Stabilize Program, which is open to for-profit organizations, – $5 million to support this program comes from a one-time funding transfer from the Community Facility and Enhancement Program (CFEP) to the CIP program. Over the long term, funding for the CFEP will remain in the ministry's budget. Additionally, the funding for CIP covers the CIP Project-Based grant, the CIP Operating grant, Major Cultural and Sporting Events, Multiculturalism, Indigenous and Inclusion Grant, the Enhanced Capacity Advancement Program, the Volunteer Screening Program and Volunteer Week, and Culture Days.

The OI program will receive $2.0 million, a small increase of $500 thousand compared with Budget 2020 to support programs such as the Women in STEM Award (see figure 8). Funding for Major Fairs has been on the decline since 2019 – approximately 39% or $4.3 million less than Actual 2019. Compared to Budget 2020, this is a $2.2 million decrease.

Capital Grants for Community and Voluntary Support Services are set to decrease by 23% or $13.1 million this budget year when compared to Budget 2020 (see figure 7). CFEP has been decreasing since 2019; its Actual in 2019 was $25.2 million, whereas in 2021 it’s set to receive $18.5 million – a decrease of 26% or $6.5 million compared to 2019 and 2020.

Capital grants for Support for Culture Infrastructure are set at $4.5 million for 2021-22 – the program received $13.3 million in 2019 and $13.4 million in 2020. This is not an allocated budget amount but capital for organizations that apply for funding greater than $1 million. This budget year is the last of a three-year commitment that the government has made to three organizations to support the building and maintenance of community focused infrastructure to enhance the lives of Albertans. Existing projects include the Telus World of Science and Winspear Centre in Edmonton, as well as the Vivo for Healthier Generations in Calgary. This budget year, the 2021 Capital Plan will invest $15.5 million over three years towards the Calgary Zoo Canadian Wilds Redevelopment project to incorporate major upgrades and planned expansions.

Figure 8: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, and Budget 2021.

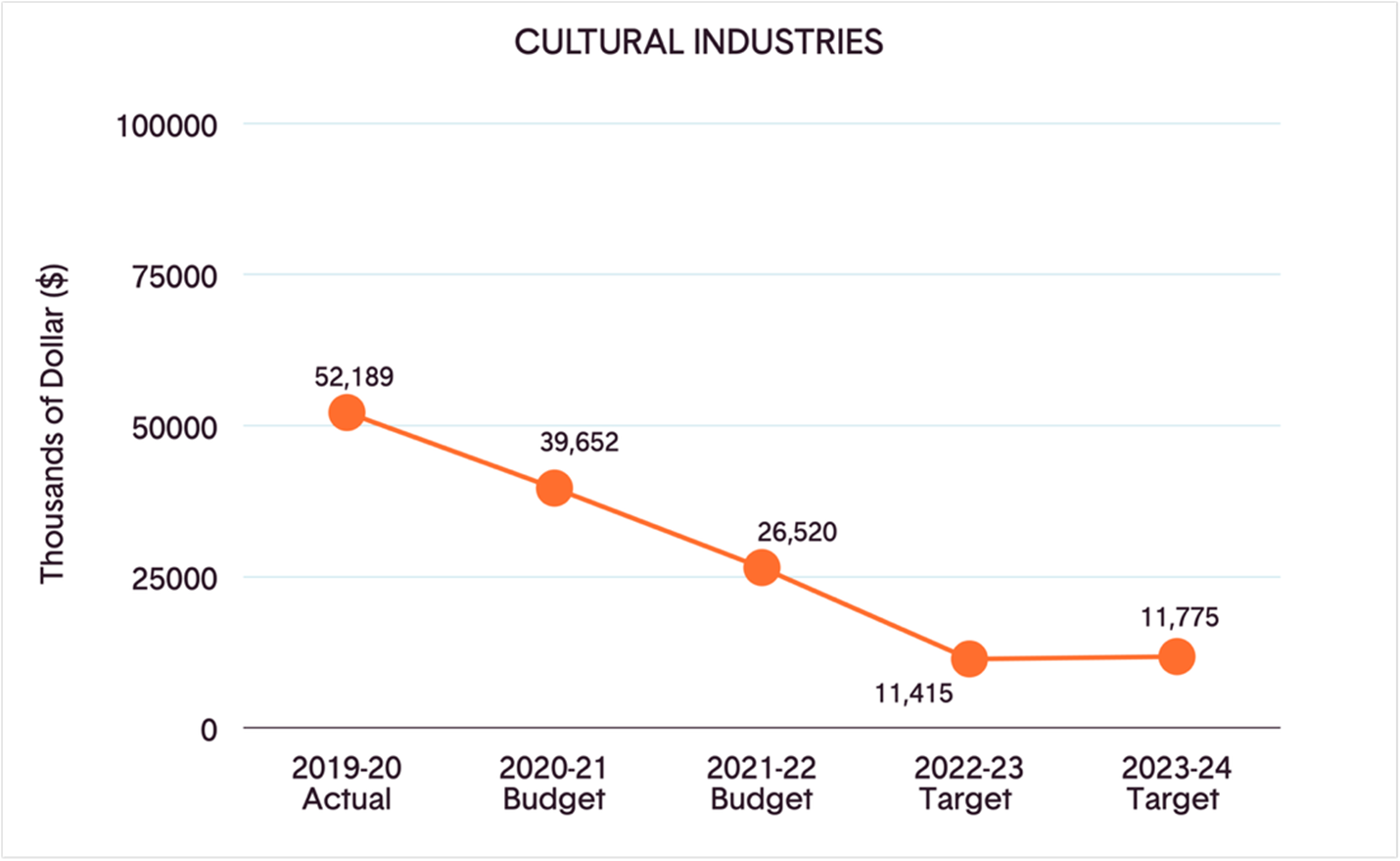

Cultural Industries

For Cultural Industries, the total budget is $26.5 million and its budget has decreased since 2019 – by approximately $25.7 million in comparison to 2019 and $13.1 million in comparison to 2020 (see figure 9). The Alberta Media Fund will receive $19.8 million this year, a 36% decrease compared to 2020 and a 56% decrease compared to 2019.

Figure 9: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

The Alberta Production Grant, which covered 25% of eligible Alberta production costs to a maximum of $125,000, is no longer an active program and the Screen-based Production Grant has transitioned to the Film and Television Tax Credit (FTTC) and moved to the Ministry of Jobs, Economy and Innovation. The FTTC offers a refundable Alberta tax credit on eligible Alberta production and labour costs to corporations that produce films, television series, and other eligible screen-based productions in the province. Alberta-owned productions can be eligible for either a 30% or 22% tax credit.

Arts & The Francophone Secretariat

This budget year, the Arts division is allotted $26.7 million. In comparison to 2020, this is a reduction of $1.8 million and a decrease of $3.1 million from 2019. Based on the targets for 2022 and 2023, there are no further decreases in sight in the next two years.

The Alberta Foundation for the Arts (AFA) will see a decrease of $1.3 million compared to Budget 2020. For Budget 2021, AFA will receive $25.6 million.

There are no major changes for the Francophone Secretariat; a total of $1.4 million has been allotted for this area in Budget 2021.

Figure 10: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Heritage

Heritage will receive $48.4 million this year, a reduction of $4.6 million from the previous year (see figure 11). This budget year, funding for Provincial Heritage Organizations is restored to pre-pandemic levels set in Budget 2020 and will be distributed to six heritage organizations, with the addition of the Francophone Historical Society of Alberta. Additionally, reductions in 2021 will be seen in funding for government operated museums and historic sites, partially due to reduced revenues because of the pandemic. When comparing Budget 2021 to Actual 2019, there is a $10.4 million decrease.

Figure 11: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023 to Budget 2021.

Although the Heritage division does not see extreme reductions in their budget, this does not do well to support museums that have had severe and detrimental impacts from closures. The Alberta Museums Association (AMA) states that “prolonged closure of museums has had severe and direct impacts on the financial sustainability of our sector, challenges that threaten permanent closures and a loss of heritage and community vitality across our province.”[9]

Two grant funding streams that are available for 2021 are:

$1.5 million for the Heritage Preservation Partnership Program; and

$1.7 million for the Support for Provincial Heritage Organizations.

Sport, Physical Activity and Recreation

The overall Sports, Physical Activity and Recreation budget is $20 million – a steady decrease since 2019. In comparison to Budget 2020, this is a decrease of $1.6 million. The decrease is a result of funding cuts to the Multi-Sport Games, a $1.6 million decrease from 2020, and a comprehensive program review resulting in government efficiency cuts.

Figure 12: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Status of Women and Multiculturalism

This year, the Status of Women and Multiculturalism division will maintain stable funding. This division will get $4.1 million in funding for programming (not grants).

Figure 13: Comparing Dollar Increase/Decrease of 2019 Actuals, Budget 2020, Budget 2021, Budget target 2022 and Budget target 2023.

Priority Areas of Investment for the Government of Alberta

Labour and Immigration

The Budget 2021-22 emphasizes “getting Albertans back to work” by reducing employment costs for employers and retraining employees so they can be better equipped for the workforce. In addition, the Budget is hyper-focused on skilled immigrants, with a new Alberta Advantage Immigration Strategy to address job creators' needs, spur economic growth, and address labour shortages. The new streams of the Alberta Immigrant Nominee Program (AINP) will focus on International Graduate Entrepreneurs, Foreign Graduate Start-Up Visas, Rural Entrepreneurs, and Rural Renewal. The Alberta Immigrant Nominee program is expected to attract new entrepreneurs from abroad and increase immigration to the province.

The mandate of the Ministry of Labour and Immigration is to provide training and re-training programs to help unemployed and underemployed Albertans find and keep a job. The ministry also provides support for job creators in Alberta. The total budget for the ministry is $330.4 million in Budget 2021. This represents an increase of $121.5 million from Budget 2020. The majority of the increase is attributable to the Workforce Strategies division – approximately $133.6 million for this budget year. This is mainly an investment of $136 million over three years into the Alberta Jobs Now program.

Alberta Jobs Now aims to “reduce employer costs to hire and train unemployed workers.”[10] The program is expected to create jobs and stimulate economic recovery. Employers are able to apply for this funding to train new employees and in turn create employment opportunities, and skills development. This program is subject to federal approval as the criteria permitted only 20% of the funding to be re-profiled into 2021-22.[11] Although details of the program are yet to be released, if nonprofits are eligible for the program, it will benefit many organizations.

The second greatest investment within the Workforce Strategies division is funding for the Coal Workforce Transition Program – a program that provides financial assistance for re-employment, retirement, relocation, and education as workers prepare to start new jobs or retire. A total of $18.6 million is allocated for 2021 which is a 149% or $11.1 million increase from Budget 2020. All other areas within the Workforce Strategies division will receive some cuts.

Jobs, Economy and Innovation

The priority of Jobs, Economy and Innovation, formerly Economic Development, Trade and Tourism, is to “get Albertans back to work” through policies, strategies, and programs that increase investment and trade into the province’s economy. The ministry’s overall budget is $437.9 million, an increase of $131.9 million from Budget 2020. The highest investment is for the Alberta Innovates Corporation with a total of $252.2 million.

Tourism and Economic Development is expected to receive an additional $60.6 million compared to 2020 with an overall budget of $143.9 million. With the Travel Alberta Corporation, the ministry is developing a 10-year Tourism Strategy to double tourism in the province by 2030.

What’s Next?: Looking Forward to Economic Recovery that Includes Nonprofits

Government budgets reflect the values and priorities of the government – one that is carefully planned in response to public opinion and consultations. In a September 2020 poll by ThinkHQ Public Affairs Inc., 39% of Albertans felt that the provincial government should be spending more to support nonprofits in Alberta, compared to just 15% who think the government should be spending less. One respondent indicated that “it is never a mistake to invest in our people. Now is not the time to be cutting back on social services and community supports.”[12] Budget 2021 does not reflect the opinions of Albertans who have made it clear that they want the provincial government to invest in the nonprofit sector, which is working daily to lead our communities through recovery. Budget 2021 also fails to recognize the value of the sector as part of the province’s Economic Recovery Plan.

CCVO will continue to work on securing a Social Infrastructure Fund for Budget 2022, building on our previous work. A Social Infrastructure Fund will enable society to work effectively through the commitment of 3.5% or $350 million, of the total budgeted amount of $10 billion allocated towards the Alberta Recovery Plan. This fund will support community focused recovery that will create jobs and spur economic stimulus.

Social infrastructure includes a range of social service sectors, policy areas, and activities that enable society to work effectively. It includes areas that help individuals, families, groups, and communities meet their social needs such as health and human development.[13] Not all social infrastructure is physical capital – it also includes human capital and public services.[14] A strong social infrastructure investment influences an area’s livability. Investment in cultural facilities, public art, parks, libraries, galleries, and museums brings in tourism revenue, makes businesses want to trade, and encourages investors to invest.[15] This investment improves the standard of living in a community by providing access to jobs through good transportation; public spaces such as cafes, sports facilities, and education buildings; and services and organizations that provide health, education, and training.

An investment in social infrastructure creates more jobs than similarly sized capital investment in physical infrastructure like construction and will address the decline of women in the workforce. A $350 million investment for social infrastructure will create approximately 4,800 jobs while the same dollars in construction would create just under 2,000 jobs.[16] Overall, investment in social infrastructure will:[17]

Create jobs for women and people of colour.

Invest in local community efforts that are well-positioned as a unique tool for economic recovery.

Strengthen social finance and social enterprise.

CCVO has just completed an in-depth consultation with stakeholders across the province on our Social Infrastructure ask to the provincial government. Based on the rich feedback we have received, we will be updating that ask and providing materials, messages, and opportunities to support a request for a Social Infrastructure Fund. Check out our website for the latest #ABCommunityAdvantage updates – or subscribe to our newsletter, and policy updates email to stay in the know!

References

[1] This GDP amount includes municipalities, universities, schools and hospitals. Source retrieved from: Calgary Chamber of Voluntary Organizations (CCVO). (March, 2019). Alberta’s nonprofit sector infographic. https://static1.squarespace.com/static/5aef5b46cef3728571e6c46c/t/5c89815deef1a13650ee003f/1552515421582/CCVO+Nonprofit+Sector+Infographic.pdf

[2] Government of Alberta. (2021a). Budget 2021 Strategic Plan 2021-24. Available at: https://open.alberta.ca/publications/budget-2021

[3] Business Council of Alberta. (August, 2020). Child care subsidy redesign and what it means for Albertans. https://www.businesscouncilab.com/work/child-care-subsidy-what-it-means-for-albertans/

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] Government of Alberta. (2021b). Working Parents Benefit. https://www.alberta.ca/working-parents-benefit.aspx?utm_source=google&utm_medium=sem&utm_campaign=LNL&utm_term=WorkingParents&utm_content=v1&gclid=Cj0KCQjwrsGCBhD1ARIsALILBYqgfw-xPjCdoNCV6X3F3kOoxcdVbib2S3hb3u9KBEAM1cdwIFd0EzgaAgXDEALw_wcB

[8] Calgary Chamber of Voluntary Organizations. (July, 2020). From Emergency to Opportunity: Building a Resilient Alberta Nonprofit Sector After COVID-19. https://static1.squarespace.com/static/5aef5b46cef3728571e6c46c/t/5f2981a48dd96d177c927d2f/1596555687803/From+Emergency+to+Opportunity+CCVO+Report+July+2020.pdf

[9] Alberta Museums Association. (2021). Membership Advisory: Government of Alberta Budget 2021.

[10] Government of Alberta. (2021c). Budget 2021 Fiscal Plan, Protecting Lives and Livelihoods 2021-24. Available at: https://open.alberta.ca/publications/budget-2021

[11] Ibid.

[12] Province-wide poll facilitated by ThinkHQ Public Affairs Inc. Field dates September 8 to 11, 2020. A sample size of 1,135 respondents weighted to reflect gender, age, and region of Alberta population according to Statistics Canada.

[13] International Trade Union Confederation. (2016). Investing in the Care Economy: A gender analysis of employment stimulus in seven OECD countries. https://www.ituc-csi.org/IMG/pdf/care_economy_en.pdf

[14] Community Links (2018). Valuing Social Infrastructure. http://www.civilexchange.org.uk/wpcontent/uploads/2018/06/Valuing-Social-Infrastructure-final.pdf

[15] Ibid.

[16] G. Kent Fellows, Research Associate and Associate Program Director, Canadian Northern Corridor at the School of Public Policy, University of Calgary, used “non-profit institutions serving households” labour multiplier from Statistics Canada to derive this approximate number. The “non-profit institutions serving households” simple multiplier is 13.702.

[17] CCVO. (December, 2020). Written submission for the pre-budget consultations in advance of the 2021 Alberta provincial budget. https://static1.squarespace.com/static/5aef5b46cef3728571e6c46c/t/5fc9380de5fc754319b82863/1607022628241/CCVO+Alberta+2021+Pre-Budget+Submission+

Endnotes

[i] The comparisons made throughout this report represent changes from the 2019 Actuals, Budget 2020 and Budget 2021 expenditure estimates for specific programs and consolidated totals for all ministries mentioned in the report. This report does not reflect the subsequent changes to funding made after the release of Budget 2020 in February 2020. Additionally, this analysis does not take inflation into account.